Your employees keep the lights on—but one payroll mistake could shut them off.

40% of small businesses face IRS penalties annually for payroll errors, costing thousands in fines and employee trust. Whether you’re hiring your first team member or scaling to 50, paying employees isn’t just about signing checks. It’s about navigating tax labyrinths, dodging legal landmines, and choosing systems that save time and money.

In this guide, you’ll learn:

- 3 payroll methods (and which one 93% of businesses use to avoid headaches).

- IRS-approved strategies to classify workers correctly and sidestep $1,000+ fines.

- Automation tools that slash admin work by 80% (like Gusto’s self-service portals).

- Free templates for calculating overtime, deductions, and tax filings.

Let’s turn payroll from your biggest worry into your smoothest operation.

Key Takeaways

- 40% of small businesses face IRS penalties annually due to payroll errors—avoid them with proper systems.

- Automating payroll can save up to 80% of administrative time and reduce errors by 50%.

- Compliance isn’t optional: Misclassifying employees can cost $1,000+ per violation.

- The right payroll software (like Gusto or QuickBooks) streamlines taxes, benefits, and direct deposits.

Step 1: Understand Your Payroll Options

Payment Methods

Choosing the right payment method impacts employee satisfaction, administrative workload, and compliance. Here’s a detailed breakdown:

1. Direct Deposit

- How It Works: Electronically transfers wages to employees’ bank accounts.

- Best For: Businesses with consistent cash flow and tech-savvy teams.

- Setup:

- Collect banking details (routing and account numbers) via secure forms.

- Partner with a payroll provider (e.g., Gusto) or your business bank (e.g., Chase Business Banking).

- Cost: 0.50–0.50–2.50 per transaction. Some banks waive fees for bulk transfers.

- Compliance: Must comply with the Electronic Fund Transfer Act (EFTA). Provide pay stubs detailing deductions.

Case Study: Green Thumb Landscaping reduced payroll processing time by 60% after switching to direct deposit via Gusto.

2. Paper Checks

- How It Works: Physical checks issued to employees.

- Best For: Businesses with limited internet access or older employees who prefer tangible pay.

- Risks:

- Check Fraud: 63% of businesses experienced check fraud in 2024 (AFP).

- Manual Errors: Misplaced decimals or incorrect amounts.

- Mitigation: Use check-printing software (e.g., QuickBooks) with built-in fraud detection.

3. Digital Wallets & Pay Cards

- Options: PayPal, Venmo, PayActiv (pay cards).

- Best For: Gig workers, freelancers, or remote teams.

- Legal Considerations:

- State Laws: California and New York ban mandatory pay cards; employees must opt-in.

- Fee Transparency: Pay cards cannot charge excessive ATM fees (DOL Regulation 2023).

- Example: Urban Eats Food Truck uses PayActiv cards for seasonal staff, saving $200/month on check-printing costs.

Payroll Schedules

Your schedule affects cash flow, employee morale, and compliance.

1. Weekly

- Structure: Pay every Friday.

- Pros: Preferred by hourly workers (e.g., retail, construction). Reduces financial stress.

- Cons: Increases administrative work (52 pay periods/year).

- Ideal For: Industries with overtime-heavy workweeks.

2. Bi-Weekly

- Structure: Pay every other Friday (26 pay periods/year).

- Pros: Balances consistency and workload. Used by 43% of small businesses.

- Cons: Complicates monthly budgeting for employees.

- Example: TechStart Inc. uses bi-weekly pay to align with contractor billing cycles.

3. Semi-Monthly

- Structure: Pay on the 15th and last day of the month (24 pay periods/year).

- Pros: Simplifies accounting for salaried employees.

- Cons: Confusing for hourly workers (uneven hours per period).

4. Monthly

- Risks: 34% of employees report difficulty budgeting with monthly pay (Pew Research).

- Legal Restrictions: Banned for hourly workers in 21 states (e.g., California, Michigan).

Tax Compliance

Payroll taxes are non-negotiable. Here’s how to stay compliant:

1. Federal Taxes

- Withhold:

- Income Tax: Use IRS Publication 15-T to calculate brackets.

- FICA: 6.2% Social Security (up to $168,600 wage base) + 1.45% Medicare.

- Employer Contributions: Match employee FICA (7.65% total).

2. State & Local Taxes

- Income Tax: Rates vary widely (e.g., 0% in Texas vs. 13.3% in California).

- Unemployment Tax (SUTA): Avg. 1–6% of first $7,000 wages (varies by state).

- Paid Leave: Mandatory in 12 states (e.g., Washington’s 0.6% payroll tax for family leave).

Tool: Gusto’s AutoFile automatically calculates and remits state taxes.

3. Reporting Deadlines

- Form 941: Quarterly federal tax filing (due April 30, July 31, etc.).

- Form 940: Annual federal unemployment tax (due Jan 31).

- W-2s: Distribute to employees by Jan 31; file with SSA by Jan 31.

Penalty Alert: Late W-2s cost 50–50–550 per form (IRS).

Misclassifying employees can trigger audits. Ensure you’re withholding the right taxes by setting up payroll correctly from day one.

Employee Classification

Misclassification is the #1 payroll mistake. Use this guide:

1. W-2 Employees

- Benefits: Minimum wage, overtime, workers’ comp, unemployment insurance.

- Control Test: If you dictate hours, tools, or methods, they’re likely employees.

2. 1099 Contractors

- Criteria:

- Autonomy: Contractors control how and when work is done.

- Tools: Provide their own equipment (e.g., freelancers using personal laptops).

- Multiple Clients: Not reliant on your business for income.

- IRS Form SS-8: File to request official classification determination.

Case Study: Bright Media faced a $12,000 fine for misclassifying 5 writers as contractors.

Properly classifying workers as W-2 employees or 1099 contractors starts during the hiring process. Misclassification can lead to costly penalties, so ensure your employee onboarding checklist includes clear documentation of roles and tax forms.

Step 3: Choose the Right Payroll Software

Key Features to Compare

| Feature | Why It Matters | Top Tools |

|---|---|---|

| Auto-Tax Filing | Avoid penalties; updates with tax law changes | Gusto, QuickBooks, OnPay |

| Time Tracking | Sync hours with payroll; reduce manual entry | TSheets, Deputy, Rippling |

| Benefits Admin | Manage health insurance, 401(k), and PTO | Gusto, BambooHR, Zenefits |

| Scalability | Grow from 5 to 500 employees seamlessly | ADP, Paychex, Rippling |

Software Deep Dive

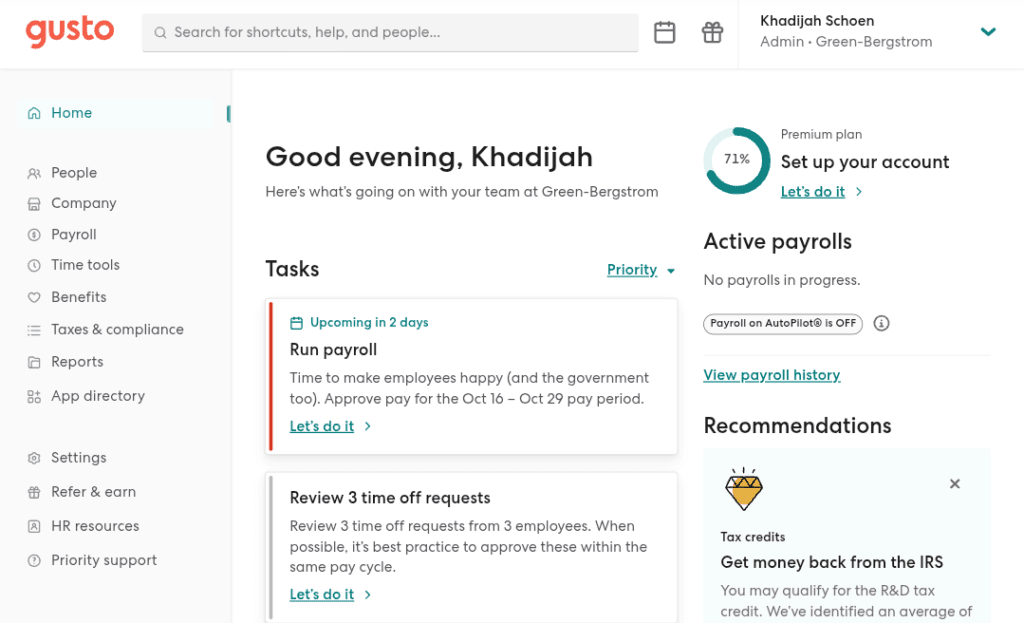

1. Gusto

- Pricing: $40/month + $6 per employee.

- Standout Features:

- Health Insurance Brokerage: Offers group plans for small businesses.

- Contractor Payments: 1099s auto-filed with IRS.

- Best For: Startups needing HR + payroll in one platform.

2. QuickBooks Payroll

- Pricing: $45/month + $6 per employee (Full Service).

- Standout Features:

- Accounting Sync: Direct integration with QuickBooks Online.

- Same-Day Direct Deposit: Pay up to 50 employees instantly.

- Best For: Businesses already using QuickBooks for accounting.

3. ADP RUN

- Pricing: Custom (Starts at $30/month + $5 per employee).

- Standout Features:

- Global Payroll: Pay international contractors in 140+ currencies.

- HR Advisory: 24/7 access to certified HR experts.

- Best For: Scaling businesses with complex compliance needs.

Tools like Gusto automate taxes, benefits, and compliance—critical for businesses still learning how to set up payroll systems. For a deeper dive into software comparisons, visit our complete payroll setup guide.

Step 4: Execute Flawless Payroll Processing

The Payroll Process: Step-by-Step

Follow this detailed workflow to ensure error-free payroll execution.

1. Pre-Payroll Preparation

- Collect Employee Data:

- New Hires: W-4 (federal tax withholding), I-9 (employment eligibility), and state-specific forms (e.g., California’s DE 4).

- Bank Details: Routing and account numbers for direct deposit.

- Benefits Enrollment: Health insurance, retirement plans, and garnishments (e.g., child support).

- Verify Time Records:

- Hourly Workers: Use time-tracking tools like TSheets or Hubstaff to log hours.

- Overtime: Confirm compliance with FLSA (1.5× pay after 40 hours/week).

Tool: QuickBooks Time auto-syncs hours to payroll software, reducing manual entry.

2. Calculate Gross Pay

- Hourly Employees:

- Formula: (Regular hours × hourly rate) + (Overtime hours × 1.5× rate).

- Example: 45 hours at $20/hour = (40 × 20) + (5 × 30) = $950.

- Salaried Employees:

- Formula: Annual salary ÷ number of pay periods.

- Example: $60,000/year ÷ 24 pay periods = $2,500 per check.

- Bonuses/Commissions:

- Taxed at 22% federal supplemental rate.

Common Mistake: Forgetting to include PTO or holiday pay in gross wages.

3. Deduct Taxes & Benefits

- Mandatory Deductions:

- Federal: Income tax (use IRS withholding tables) + FICA (7.65%).

- State: Varies (e.g., 5% in Colorado, 0% in Texas).

- Local: NYC requires a 3.876% income tax.

- Voluntary Deductions:

- Health Insurance: $300/month (employee contribution).

- 401(k): 3–5% of salary (pre-tax).

- Wage Garnishments: Up to 25% of disposable income (federal limit).

Tool: Gusto auto-calculates deductions and generates pay stubs.

4. Distribute Payments

- Direct Deposit: Process 2–3 days before payday to meet ACH deadlines.

- Paper Checks: Print checks with security features (watermarks, MICR ink).

- Digital Wallets: Ensure compliance (e.g., Zelle for instant transfers).

Case Study: Sunrise Bakery reduced late payments by 90% using ADP’s same-day deposit feature.

5. File Reports & Maintain Records

- Federal:

- Form 941: Quarterly filing of withheld taxes (due by the last day of the month post-quarter).

- Form 940: Annual federal unemployment tax (FUTA).

- State:

- UI-3: Quarterly unemployment reports (e.g., Illinois).

- Employee Records:

- Retain payroll records for 4 years (FLSA requirement).

Penalty Alert: Late Form 941 filings incur a 5% penalty per month (up to 25%).

Step 5: Avoid Costly Mistakes

Top 5 Payroll Errors & Fixes

- Misclassifying Employees

- Risk: $1,000–$5,000 fines per worker (DOL).

- Fix: Use the IRS’s Common Law Test to verify status.

- Missing Tax Deadlines

- Risk: 2–15% penalty on unpaid taxes + interest.

- Fix: Set calendar alerts for key dates:

- April 30: Q1 Form 941.

- January 31: W-2 distribution.

- Miscalculating Overtime

- Risk: Back pay + liquidated damages (up to 2× owed wages).

- Fix: Use Timeero to auto-calculate overtime rates.

- Ignoring State-Specific Laws

- Example:

- California: Daily overtime after 8 hours.

- Colorado: Paid sick leave accrual (1 hour per 30 worked).

- Fix: Subscribe to Paycor for state-law updates.

- Example:

- Poor Recordkeeping

- Risk: Audits + inability to dispute claims.

- Fix: Use Zenefits to store digital records securely.

Case Study: TechWave Solutions saved $15,000 in penalties after switching to automated compliance alerts via Rippling.

Step 6: Optimize Costs

DIY vs. Outsourced vs. Hybrid

| Approach | Cost/Month | Pros | Cons |

|---|---|---|---|

| DIY | $200 | Full control; low upfront cost | Time-consuming; high error risk |

| Outsourced | $500 | Hands-off; expert compliance | Expensive for small teams |

| Hybrid | $300 | Balance cost/control | Requires coordination |

Cost-Saving Strategies

- Negotiate Software Discounts:

- Ask for annual billing (saves 10–15%) or nonprofit rates.

- Audit Payroll Taxes Annually:

- Correct overpayments (e.g., FUTA over $7,000 wage base).

- Use Free Tools:

- Wave Payroll: Free for basic payroll (under 10 employees).

- IRS EFTPS: Free federal tax payments.

- Outsource Complex Tasks:

- Hire a CPA for $150/hour to handle quarterly filings.

Case Study: Maplewood Retail cut payroll costs by 30% using a hybrid model (Gusto + quarterly CPA reviews).

ROI-Boosting Add-Ons

- Employee Self-Service Portals:

- Reduce HR queries by 40% (e.g., Gusto’s portal for tax forms).

- Integrated Time Tracking:

- QuickBooks Time syncs with payroll, cutting data entry by 50%.

- Automated Compliance Updates:

- Paychex alerts you to law changes in real time.

Final Tip: Audit Annually

Review your payroll system each year. Update tax tables, reclassify employees if roles change, and solicit feedback from staff.

FAQs

How do I handle overtime?

Non-exempt employees earn 1.5× hourly rate after 40 hours/week. Track time with apps like TSheets.

What if I can’t afford payroll software?

Start with free tools like Wave Payroll (free for basic features) or Excel templates.